The new maneuver intends to cut the deduction to 19% of health and related costs for incomes above 120 thousand euros, resetting it to 240 thousand euros.

Don't store avocado like this: it's dangerousFarewell to the 19% tax deductions for health and related expenses already from 2020. This is the proposal that comes from the draft of the tax decree connected to the 2020 Budget Law and which provides for new cuts only for the wealthiest classes.

The measure that anticipates the contents of the next Budget Law, being defined in conjunction with the related tax, introduces in fact "an income threshold beyond which the IRPEF subsidy relating to deductible charges at 19% would gradually be zeroed".

This is what is stated in the draft budget sent to Brussels, which also specifies that "the deductions for expenses for interest expense on mortgages will be reserved".

This means that an income threshold will probably be introduced beyond which the IRPEF subsidy relating to 19% deductible charges it gradually becomes zero, affecting the possibility of deducting expenses such as health, personal or family members with disabilities.

But not for everyone: there is talk of a mechanism to decrease starting from 120 thousand euros per year, to get to zeroing at 240 thousand euros and should exclude the deductions of interest expense on mortgages.

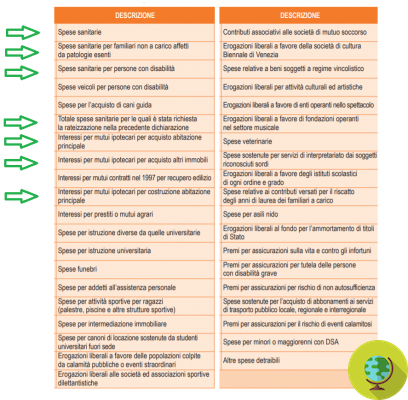

Here are the expenses that can currently be subject to 19% deductions (only for the amount exceeding 129,11 euros):

- services rendered by a general practitioner (including homeopathic medicine)

- purchase of over-the-counter or prescription medicines (including homeopathic)

- purchase (until 2018) of foods for special medical purposes, with the exception of those intended for infants

- specialist services

- services rendered by personnel in possession of the professional qualification of basic assistance or technical assistance operator exclusively dedicated to the direct assistance of the person

- services by personnel coordinating the core assistance activities

- services by personnel with the qualification of professional educator

- services rendered by qualified personnel assigned to animation and occupational therapy activities

- analyzes, radioscopic investigations, research and applications, therapies

- surgical performance

- hospitalizations for inpatient hospitalizations or related to surgical interventions

- organ transplant

- spa treatments (excluding travel and living expenses)

- purchase or rent of medical devices and health equipment (including health prostheses)

- nursing and rehabilitation care (such as physiotherapy, kinesiotherapy or laser therapy)

Read also:

- Maneuver 2020, the facade bonus is coming: 90% deductions for those who renovate the exterior of condominiums

- Stop a Baby and Mum Bonus tomorrow, the Single Check arrives until the age of majority

- Family Card: what it is, who is eligible and how to apply for the card for those with more than three children

Germana Carillo