From 1 July it is possible to request the 110% eco-bonus but there are still many doubts. Today the text of the decree will be voted on by the Budget Commission

He is about to end up run over, his mother saves himFrom 1 July it is possible to request the 110% eco-bonus which allows you to carry out a series of works by recovering the entire sum in the form of a tax deduction or discount on the invoice. At this moment the Budget Commission of the Chamber is meeting to discuss any changes to the Relaunch Decree, which introduced the eco-bonus but waiting to know if there will be other news, here is what the measure provides.

Since yesterday, the eco-bonus has been active and can be requested. Introduced by the relaunch decree, published in the Official Gazette last June 16, the superbonus really allows you to carry out a series of interventions for free increase the energy efficiency of buildings.

This is an unprecedented measure, introduced to relaunch the economy tormented by the coronavirus emergency, but also to promote energy saving for the benefit of the environment.

Index

The requirements

To obtain the eco-bonus it is necessary to carry out certain interventions in the period from 1 July 2020 to 31 December 2021. They, unlike what happens for the other tax bonuses, are recoverable not in 10 years but in 5, with as many annual installments of the same amount.

The following can obtain it: condominiums, natural persons, outside the exercise of business activities, arts and professions, on real estate units, autonomous public housing institutes (IACP) and housing cooperatives with undivided ownership.

However, we need some requirements: it can only be obtained if the interventions guarantee a increase of at least two energy classes of the building they are intended for, demonstrating this through theEnergy Performance Attestation (Ape), issued by a qualified technician. But in the event that it is not possible to jump two classes, because perhaps the building already boasts one of the highest, one is enough, always certified by Ape.

Furthermore, to date, works on single-family buildings are only eligible for the bonus if they concern the first home. It is not yet clear whether the eco-bonus can also be extended to the second home. According to the current text of the relaunch decree, the eco-bonus should not be applied

"To interventions carried out by individuals, outside of business activities, arts and professions, on single-family buildings other than the one used as a main residence".

But among the possible innovations there is the extension both to the works carried out on second homes, as long as they are different from condominiums, and to independent buildings such as terraced houses.

What are the interventions admitted to the 110% deduction

It is intended for specific interventions aimed atd increase the energy efficiency of buildings. These are two types of jobs, which, however, lead to others. This means, for example, that if you replace your air conditioning system by purchasing a condensing one, you can also combine the installation of photovoltaic systems and storage systems, which at that point would benefit from the same 110% deduction. Here they are in detail, according to the current wording of the decree:

- surface thermal insulation interventions vertical and horizontal opaques affecting the building envelope with an incidence greater than25% of the surface gross dispersant of the building itself (for example the thermal coat);

- interventions on single-family buildings or on the common parts of buildings for the replacement of winter air conditioning systems existing with centralized systems for heating, cooling or the supply of domestic hot water a condensation, with efficiency at least equal to class A of the product, with heat pump, including hybrid or geothermal systems, also combined with the installation of photovoltaic systems and related storage systems, or rather with micro-cogeneration plants.

The decree also specifies that the same deduction can be extended to all other energy efficiency interventions as long as they are carried out jointly with at least one of the interventions cited above, for example the construction of the columns to charge the batteries of electric cars. The constraint of the increase remains of at least two energy classes the building or, if not possible, the achievement of the highest class.

How much is

According to the provisions of the Relaunch decree, the expense to be deducted can reach a maximum of 60 thousand euros in the case of thermal insulation interventions of buildings, while it must not exceed 30 thousand for the replacement of air conditioning systems and interventions related to it. .

In the first case, the decree reads, "the deduction is calculated on a total amount of expenses not exceeding 60.000 euros multiplied by the number of real estate units that make up the building".

In the second, "the maximum deductible expense is 30.000 euros, multiplied by the number of real estate units that make up the building in the case of interventions on common parts".

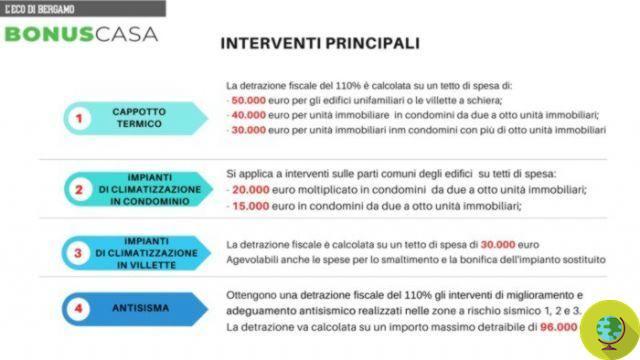

However, such spending limits may change. Among the possible innovations under consideration in the Chamber is the identification of three different thresholds:

- 50.000 euros for single buildings;

- 40.000 euros for works in condominiums with up to 8 residential units;

- 30.000 euros for works in larger condominiums

Doubts about credit transfer and invoice discount

Unfortunately, even if theoretically it is already possible to request the eco-bonus since yesterday, the text is currently being examined by the Budget Commission of the Chamber which could introduce various innovations. One of all that concerns the purely economic aspect of the 110% eco-bonus, which should then be clarified by the Revenue Agency.

The latter should disclose the operating instructions for the assignment of credit and the discount on the invoice. The deadline for issuing the provision is set at 30 days after the conversion date of the Relaunch decree.

Even today, the Agency has not clarified the operating instructions for the assignment of the credit and the discount on the invoice.

Today the Budget Commission will vote on the proposed amendments and the passage of the conversion law in the Chamber is set for tomorrow, if there is no further news. Only then will we know more.

To read the full text of the decree click here

Sources of reference: Tax information, Government

READ also:

110% window bonus: the requirements and how to request it

"Free" home renovation: 110% eco-bonus confirmed in the relaunch decree