How to install a photovoltaic system in an apartment building?

He is about to end up run over, his mother saves him

Install a plant photovoltaic in the condominium it is a good opportunity to self-produce at least part of the electricity that is consumed and, consequently, to reduce the electricity bill. Unfortunately, with the end of the Fifth Energy Bill, it is no longer possible to access state incentives for photovoltaics and, therefore, to earn with solar power. However, there remains the possibility of use the 50% personal income tax deductions to amortize half of the costs incurred for the plant.

However, it is good to clarify immediately. Install the photovoltaic in the condominiumin fact, it can mean two distinct and separate things. The first: mount the photovoltaic panels to power the condominium in its entirety; the second: mount the panels to supply a single apartment of an apartment building. The difference is noticeable.

In the case ofreal condominium systemIn fact, the photovoltaic modules can only be used to supply energy to strictly condominium users: lifts, lights, electric gates or shutters, water autoclaves, etc. The excess energy can be consumed later thanks to the exchange on the spot, but it will not be able to feed the consumption of a single home (or more houses) of the condominium.

In the case of a private system serving an apartment in a condominiumOn the other hand, the exact opposite is true: it will serve to feed the domestic consumption of that residential nucleus, not the common ones of the building. Even in this case, however, it will be possible to use the exchange on the spot to temporally divide the production and consumption of electricity.

Index

Condominium photovoltaic

If the photovoltaic system will have to be serving the consumption of the entire condominium the rules to follow are those of the very recent legge 220 of 11-12-2012, entered into force on 18-06-2013. This law, the so-called "Reform of the condominium ", provides new specific articles for the installation of renewable sources in buildings. Important article 5 of the law:

Art 5

1. After the first paragraph of article 1120 of the civil code, the following are inserted:

«The condominiums, with the majority indicated in the second paragraph of article 1136, may provide for the innovations which, in compliance with the sector regulations, have as their object: 1) the works and interventions aimed at improving the safety and health of buildings and systems; 2) the works and interventions planned to eliminate architectural barriers, to contain the energy consumption of buildings and to create parking spaces intended for the service of the real estate units or the building, as well as for the energy production through the use of cogeneration plants, wind, solar or in any case renewable sources by the condominium or by third parties who obtain for consideration a real or personal right of enjoyment of the flat roof or other suitable common surface; 3) the installation of centralized systems for radio and television reception and for access to any other kind of information flow, including from satellite or cable, and the relative connections up to the branch for individual users, with the exception of systems that do not involve changes capable of altering the destination of the common property and preventing other condominiums from using it according to their law. The administrator is required to convene the meeting within thirty days from the request of even a single condominium interested in the adoption of the resolutions referred to in the previous paragraph. The request must contain an indication of the specific content and methods of carrying out the proposed interventions. Failing that, the administrator must promptly invite the proposing condominium to provide the necessary additions ".

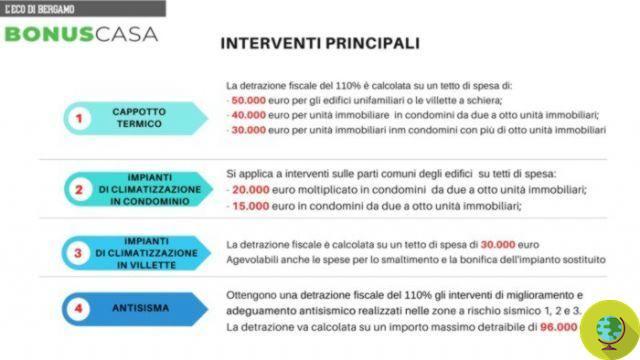

According to the reform, therefore, if i condominiums want to install a photovoltaic system at the service of the entire condominium, the decision must be taken with a majority of the condominiums present at the assembly provided that they represent at least the half the value of the condominium. Those who disagree, of course, can exempt themselves from paying the costs of the condominium photovoltaic system. Those who pay, on the other hand, can deduct their share from taxes through the normal 50% personal income tax deduction which, for condominium works, is extended until June 30 2014 and not, as in the case of deductions for work in a single apartment, until 31 December 2013.

Domestic photovoltaic in condominium

The condominium reform also provides for new specific rules relating to the case in which a single condominium want to build the photovoltaic system for personal benefit. Obviously this condominium will have to use part of the common area of the condominium to mount the solar panels, but while before he had to agree with the administrator and neighbors, now the law provides for a simplified procedure specified in article 7:

Art 7

1. The following are inserted after article 1122 of the civil code:

"Art. 1122-bis. – (Non-centralized systems radio and television reception and production of energy from renewable sources). - The installations of non-centralized systems for radio and television reception and for access to any other kind of information flow, even from satellite or cable, and the relative connections up to the branch point for the individual users are made in such a way as to carry the less damage to the common parts and to the real estate units of individual property, preserving in any case the architectural decoration of the building, except as provided for in the matter of public networks. The installation of plants for the production of energy from renewable sources is allowed intended for the service of individual units of the condominium on the flat roof, on any other suitable common surface and on the parts of the individual property of the interested party. Should modifications of the common parts become necessary, theinterested notifies the administrator indicating the specific content and methods of carrying out the interventions. The assembly may prescribe, with the majority referred to in the fifth paragraph of article 1136, adequate alternative methods of execution or impose precautions to safeguard the stability, safety or architectural decoration of the building and, for the purposes of installation of the systems referred to in the second paragraph, provides, at the request of the interested parties, to distribute the use of the solar pavement and other common surfaces, safeguarding the various forms of use provided for by the condominium regulation or in any case in progress. The assembly, with the same majority, it can also subordinate the execution to the performance, by the interested party, of a suitable guarantee for i any damage. Access to individually owned real estate units must be allowed where necessary for the design and execution of the works. Plants destined for single housing units are not subject to authorization.

In simple terms: to install a personal photovoltaic system on the condominium surface, you no longer need to have the ok of the condominiums, but one communication is enough. However, if the neighbors believe their rights have been infringed following the installation of this system, they have the opportunity to block its construction by passing through the condominium assembly. This means that, if no one is against it, everything goes smoothly otherwise the quarrels between condominiums return. In any case, however, the construction of the photovoltaic system can not damage the structural solidity of the condominium nor causing architectural and landscape damage.

The question of the flat roof and the IMU

Once you have established what and how you can do if you want install a photovoltaic system for the condominium or of a single real estate unit of the condominium, there is one last thing to pay attention to: the issue of the flat roof.

The question that many have asked in the past is: if I install photovoltaics on the roof, ithe pavement becomes buildable? And, consequently, the installation of solar on the roof changes the cadastral value of the property for the purpose of calculating IMU? The answer came recently from the Ministry of Economy, through the Finance Department, which specified that the iInstallation of the photovoltaic system on a flat roof does not imply the eligibility for the calculation of the IMU. With Resolution 8 / DF of 22 July 2013, the Ministry specified that:

the property can be qualified as a building area, in the event that no real estate unit is identifiable on the same, according to the rules laid down by art. 2 of the decree of the Minister of Finance 2 January 1998, n. 28 and consequently the tax base is given by the value of the same as detected in common 2 trade, or, otherwise, by the cadastral income associated with each real estate unit, built on the area, increases by 5%, pursuant to art. 3, paragraph 48, of the law of 23 December 1996, n. 662, and then multiplied by the coefficients established by art. 13, paragraph 4, of Legislative Decree no. 201 of 2011.

Consequently thesolar astrics, both of private and public buildings, are an integral part of the existing building and, as such, contribute to the overall determination of the cadastral income of the real estate units forming part of the building itself. Such annuities are the main element for identifying the tax base useful for the purposes of the IMU, referred to in the aforementioned art. 5, paragraph 2, of Legislative Decree no. 504 of 1992. The conclusions which have just been reached which, therefore, exclude the qualification of the flat roof - declared in the land registry on a voluntary basis - as a building area during the construction phase of the photovoltaic system are also supported by what is claimed by the Court of Cassation in the recent sentence no. 10735 of 8 May 2013.

In conclusion install photovoltaics on the roof of the house or condominium (both in the case of condominium and private system) does not change the cadastral value of the property e it does not increase the amount of the IMU.

Peppe Croce

READ also:

Fifth energy account: end of incentives for photovoltaics

Tax deduction of 50 also applies for photovoltaics