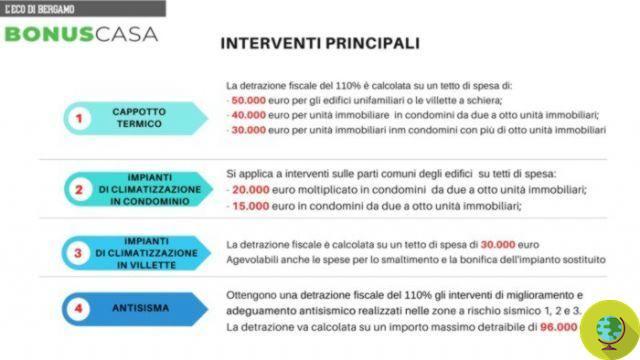

After furniture and appliances, the deductions could also concern asbestos remediation and solar shading. A new amendment to Legislative Decree 63/2013 made by the Finance and Productive Activities Commissions of Montecitorio, could extend the tax concessions already provided for building renovation also to solar shading, micro-cogeneration and micro-trigeneration in order to improve energy efficiency and also to encourage interventions to promote water efficiency

He is about to end up run over, his mother saves him

After i furnishings and appliances, the deductions could also concern the asbestos remediation and sunscreens. A new amendment to Legislative Decree 63/2013 made by the Finance and Productive Activities Committees of Montecitorio, could extend the tax breaks already provided for the building renovation also to solar shading, micro-cogeneration and micro-trigeneration in order to improve energy efficiency and also to encourage interventions to promote water efficiency.

The novelties recently introduced, they have the eco-bonuses were extended throughout 2013 and that have expanded them to other categories, may soon also affect new sectors. Primarily, asbestos. This means that the replacement of the covers of eternity in buildings could benefit from deductions.

The deadline for tabling amendments to the Commission also passed two days ago. For this, by the end of this week the text of the Dl 63/2013, which contains the 65% tax deduction on energy efficiency interventions and its modifications, will be able to obtain the definitive ok. It should be remembered that the decree transposes the 2010/31 / EU directive on energy performance in buildings.

As we know, the decree was already examined by the House and Senate, discussed by the House Committees and still modified.

By the weekend the Legislative Decree 63/2013 should be converted into law, and with it the definitive rules to be followed to obtain tax deductions related to the improvement of the energy performance of buildings and beyond, currently valid until 31 December 2013.

Francesca Mancuso

READ also:

- Tax deductions: 50% bonus also for kitchens and furniture

- Tax deduction of 55%: there is no coverage for the extension, but it will be definitive

- Deductions of 55%: the 5 things to know