The enabling law has been published in the Official Gazette which introduces the single and universal allowance of 250 euros per month for each dependent child under 21.

Don't store avocado like this: it's dangerousThe single allowance for children will most likely enter full capacity on 1 July, a single allowance that will replace family allowances and other forms of support, deductions or incentives. After the definitive go-ahead of the Senate in recent days to the enabling law, the so-called "Family Bill", which introduces the single and universal allowance of 250 euros per month for each dependent child under 21, the publication in the Official Gazette arrives. But who can apply for the single check? What will it replace and, above all, what amounts are we talking about?

Published in the Official Gazette (no. 82 of 6 April), law 46 of 2021 aims, as the text mentions, to "promote birth rates, support parenthood and promote employment, especially women".

The new check will be paid every month to all taxpayers, whether they are self-employed or employees, capable or incompetent (for this "universal") and - liquidated as a tax credit or as a monthly payment of a cash sum - will be recognized for each dependent child from the seventh month of pregnancy up to the eighteenth year of age and with an increased amount from the second child onwards. However, it will be paid up to the age of 21 but reduced in amount and paid directly to the adult child in some specific cases.

In addition, the allowance will be increased - according to a rate of not less than 30% and not more than 50%, for each child with disabilities, respectively minors or adults and under the age of 21, with the amount of the increase graduated according to the classifications of the condition of disability.

The benefit can be combined with both the citizenship income and the citizenship pension and is paid together with them. The allowance is also compatible with any cash measures in favor of dependent children provided by the Regions, the autonomous provinces and local authorities. But there are cases of measures that instead of the single check will be clearly replaced, while one wonders what the amounts may be.

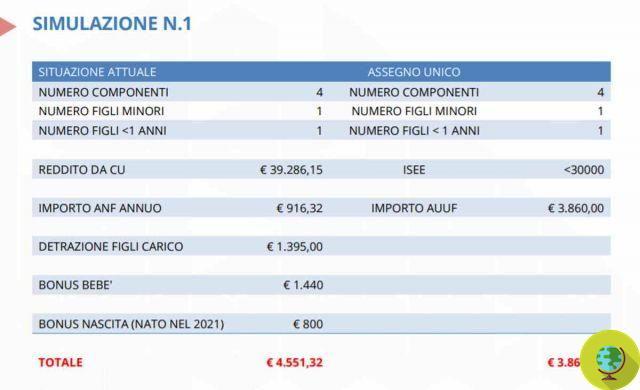

Estimates on the amounts of the'single check, simulations

How much can each family get when applying for a single allowance? According to a very detailed analysis by the Foundation for Labor Consultants Studies, a forecast can consider an amount of the constant allowance equal to 1.930 euros per year (161 euros per month) for each minor child and 1.158 euros per year (97 euros per month ) for each adult child up to 30 thousand euros of Isee (in addition to the surcharges).

By 30 thousand euros of Isee, on the other hand, the value of the allowance decreases in a non-linear way up to 52 thousand, with a downward concavity that tends to better protect the nuclei with a lower Isee. Beyond the 52 thousand Isee threshold, the allowance would remain constant at 800 euros per year (67 euros per month) for each dependent minor child and 480 euros per year (40 euros per month) for each adult child.

Here are the simulations provided by the Labor Consultant Studies Foundation:

© Foundation for employment consultants studies

The six measures that the universal check will replace

Again according to the analysis of the labor consultants, with the single check the following will then be progressively eliminated:

- the allowance for households with at least three minor children, as per article 65 of law no. 448 of 23 December 1998. This is a measure introduced in 1999 and which provides for the allocation of a monthly amount to families with three dependent children under the age of 18;

- the birth allowance

- the birth or adoption bonus, a one-off contribution for an amount of 800 euros, paid in a single installment e

due to the completion of the seventh month of pregnancy or to the act of adoption; - the birth support fund, provided for by article 1, paragraphs 348 and 349, of law no. 232 of 11 December 2016

- the personal income tax deductions for dependent children, provided for by article 12, paragraphs 1, letter c), and 1- bis, of the consolidated income tax law, referred to in the decree of the President of the Republic no. 917 of 22 December 1986

- the allowance for the family unit, provided for by article 2 of law decree n. 69 of March 13, 1988, converted with amendments by law no. 153 of May 13, 1988, as well as family allowances provided for by the consolidated text of the rules concerning family allowances,

referred to in the decree of the President of the Republic n. 797 of May 30, 1955.

The check is paid out as a monthly payment of a cash sum. If the family unit has a citizenship income or citizenship pension, the allowance is paid jointly and according to the methods of disbursement of the economic benefit relating to the same income (or pension). Receipt of the allowance is also compatible with the use of any other cash measures in favor of dependent children provided by the regions, by the autonomous provinces of Trento and Bolzano and by local authorities.

Sources: Official Gazette / Foundation for labor consultants studies

Read also:

- Single allowance for children, starting from 1 July. To whom it belongs and how much it amounts

- Single child allowance 2021: what it is, monthly amounts and requirements