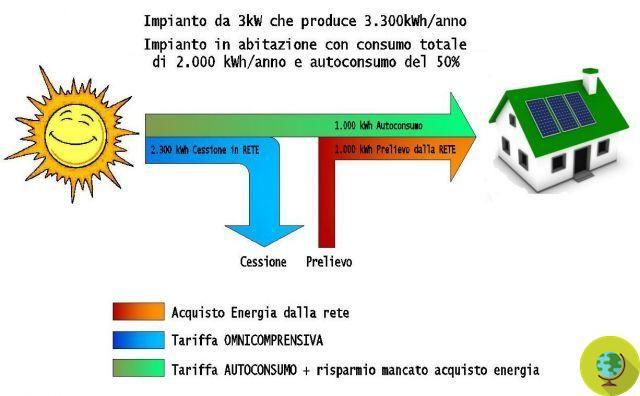

Those who intend to produce clean energy by themselves by building a photovoltaic system will have to do the math. Especially if you think, to cut your electricity bill and produce clean energy at no cost, you want to take advantage of the incentives provided by the Energy Account and thus be able to repay the cost of the investment in a few years.

He is about to end up run over, his mother saves him

Who intends to produce themselves clean energy building itself a photovoltaic system will have to do the math. Especially if he thinks, for cut your electricity bill and produce clean energy at no cost, to want to take advantage of incentives provided for by Energy account and thus be able to repay the cost of the investment in a few years.

The problem, however, is that not everyone has the necessary capital available to immediately meet the cost of solar panels. This is why many banks have equipped themselves with financing offers for individuals and companies specifically designed for those who want to invest in PV. But how to choose the most suitable loan from the many offers on the market?

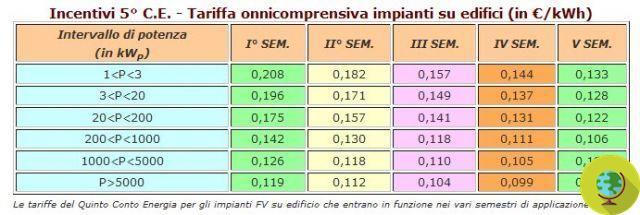

To draw up a ranking from more attractive financial packages was theFinancial Observatory, Which has compared the various offers tailored made by credit institutions for those who decide to get energy at home. The trick is in fact in choosing the loan with higher personalization rate, so as to be able to vary the duration and percentage of financing and thus be able to optimize the advantages of the Energy Account. It is about various types of financing, each conditioned by a series of parameters, such as the province in which the system is installed, the environmental and architectural impact on the territory of the structure and the power chosen.

But let's see in detail what banks offer to those who decide to do good for the environment and their wallet:

- La Banca Popolare di Milano offers Photovoltaic credit which finances 150mila euros to be returned at most in 15 years;

- Intesa Sanpaolo finances to the maximum 100mila euros with Ecological loan, to be returned at most in 15 years and also finances solar panels, thermal, boilers, fixtures, ecological vehicles and electric traction vehicles;

- then there is BNL-BNP Paribas Group with Energy Loan which finances a maximum 100mila euros and the fixed rate of 5,95%;

- Where's Banca delivers, with the product ForzaSole, at most 70mila euros with a fixed rate of 6,75% and maximum return in 15 years;

- Cariparma lends, with Trust in solar energy, at most 50mila euros (with a fixed rate of 6,50%);

- BCC Rome, with energy system, offers maximum funding 50mila euros and an unsecured mortgage also for wind farms, solar and thermal panels, geothermal, biomass, biogas plants;

- The same digit, to be returned in 10 years, also offers it Unicredit with Unsecured photovoltaic and MPS (with monthly payment over 10 years, if six-monthly over 15 years);

- Banca Sella instead it has a division dedicated to the financing of PV with Environment saddle and finances to the maximum 30mila euros to be returned in 15 years (fixed interest rate of 5,95%);

- Finally we find the People's Bank of Vicenza which finances to the maximum 30mila euros (with a fixed rate to be calculated on the IRS + spread between 1% and 2,50%).

In short, to build a photovoltaic system, also thanks to the targeted loans provided by the banks, it is still worthwhile. But a move must be made because it is not yet fully clear what it will foresee in terms of incentives for the sector Energy Tale 2011.

Read the ranking of the cheapest loans drawn up by the Financial Observatory

Rosamaria Freda