In the general silence, water went public for the first time in history, becoming a potential object of speculation

He is about to end up run over, his mother saves himIt is considered the most valuable asset in the world. Our very life depends on water but blue gold, in the general silence, was listed on the stock exchange for the first time in history, becoming a potential object of speculation. And this is how an essential public good could be treated like gold and oil.

In a world in the throes of a concrete water crisis, with high fears related to the melting of glaciers and the reduction of water availability, the last thing we needed was financial speculation. In the next few years, the price of water will fluctuate and therefore may be the object of investments and, unfortunately, of more or less legal speculations.

This is also supported by the UN, which has expressed concern about the creation of the world's first forward water market, arguing that it could favor the speculation of financiers who would treat it on a par with other raw materials such as gold and oil.

On 7 December, the CME Group launched the world's first water contract for trading with the aim of helping users manage risk and better balance competing demands for water supply and demand, in the uncertainty that threatens droughts and floods may further diminish their availability. In light of these changes, buyers and sellers will be able to negotiate a fixed price for the delivery of a fixed quantity of water in the not too distant future.

"You cannot value water as you do with other traded raw materials," said Pedro Arrojo-Agudo, Special Rapporteur on human rights for safe drinking water and sanitation. “Water belongs to everyone and is a public good. It is closely linked to all of our lives and livelihoods and is an essential component of public health. "

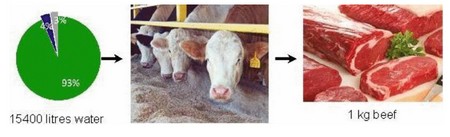

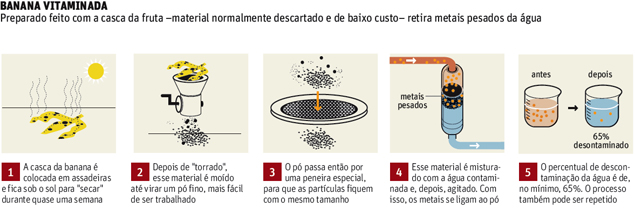

According to Arrojo-Agudo, water is already threatened by a growing population, increased demands and severe pollution related to intensive agriculture and the mining industry.

But not only. In addition to farmers, factories and utility companies trying to freeze prices, such a market could also attract speculators like hedge funds and banks to bet on prices, repeating the food market bubble in 2008.

"In this context, the risk is that large agricultural and industrial players and large utilities are the ones who can buy, marginalize and influence one of the vulnerable sectors of the economy, that of small farmers," said Arrojo-Agudo. "Water is truly a vital resource for the economy - for both large and small players - but the value of water is more than that," said Arrojo-Agudo.

Listing water on the stock exchange means not recognizing its true value, that of human right. The same right recognized in 2010 by the United Nations General Assembly and the Human Rights Council.

“While global discussions are underway on the environmental, social and cultural values of water, the news that water will be traded on the Wall Street futures market shows that the value of water, as a fundamental human right, is now under threat. ".

An inestimable value, which unfortunately today is concretely threatened.

Reference sources: OHCHR / UN

READ also:

- In the UK, fresh water could run out in as little as 25 years

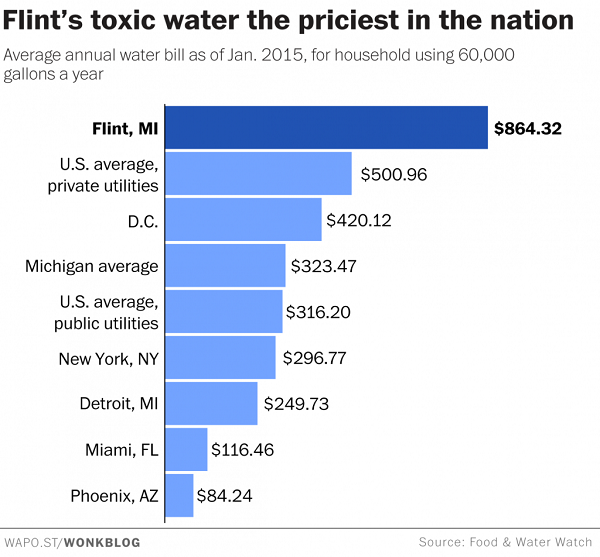

- Water: citizens pay dearly for it, but for multinationals it is free. Flint's paradox