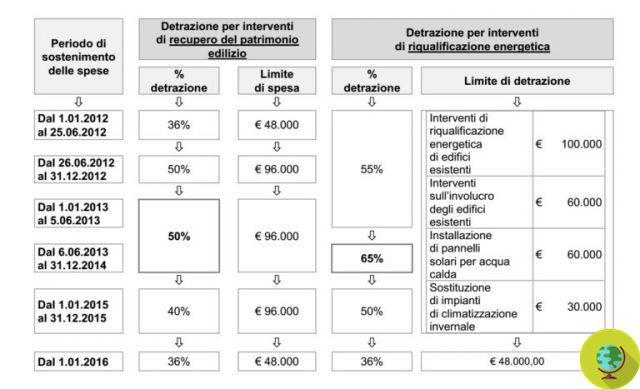

Eco-bonuses and tax deductions for renovations also in 2014. The new stability law approved by the Council of Ministers extended the personal income tax deductions expiring on 31 December 2013 by one year

He is about to end up run over, his mother saves him

Ecobonus e tax deductions for restructuring also in 2014. The new stability law approved by Cabinet ha The personal income tax deductions have been extended by one year expiring on 31 December 2013.

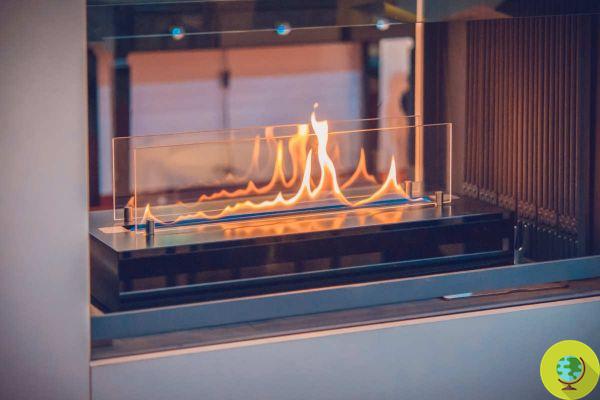

Furniture, household appliances, but also boilers and energy efficiency interventions in buildings can be facilitated through the bonus in effect this year. Eco-bonuses and restructuring incentives could therefore be valid until 31 2014 December.

La new law of stability, which will now have to pass the scrutiny of Parliament, has foreseen interventions amounting to 27,3 billion euros in the three-year period from 2014 to 2016, of which 11,6 billion next year. In particular, we read in the press release of the CdM, 14,6 billion in the three-year period will be allocated to tax relief (respectively 9 for households and 5,6 for businesses), 2,5 billion for households (1,5 for personal income tax) and 1,5 billion for businesses.

By maintaining the current rates, equal to 65% for the eco-bonus and 50% for renovations, the tax deductions will then begin to decrease from 2015 onwards.

"The refinancing of the eco-bonus is positive, a measure that helps the economy, employment, families and the green economy, in fact tens of thousands of jobs are at stake and a strong reduction in energy consumption and bills . The Chamber of Deputies asked, with a resolution unanimously approved by the Environment and Finance Commissions of which I am the first signatory together with my colleague Capezzone, the stabilization of the eco-bonus for energy efficiency in buildings and its extension starting from anti-seismic safety interventions. We will check if this is foreseen in the Government text, otherwise the measure will have to be improved in the parliamentary passage " said Ermete Realacci, president of the Environment, Territory and Public Works Commission of the Chamber.

And here, in summary, a summary deductions of 50% for renovations and 65% for the eco-bonus.

As for the former, expenses incurred up to a maximum of 96.000 € per real estate unit. There deduction of 50% also relates to the purchase of furniture and large appliances of a class not lower than A +, as well as A for ovens, for equipment for which the energy label is required, aimed at furnishing the building undergoing renovation. The deduction must be divided into 10 annual installments of the same amount, and is calculated on a total amount not exceeding 10.000 euros.

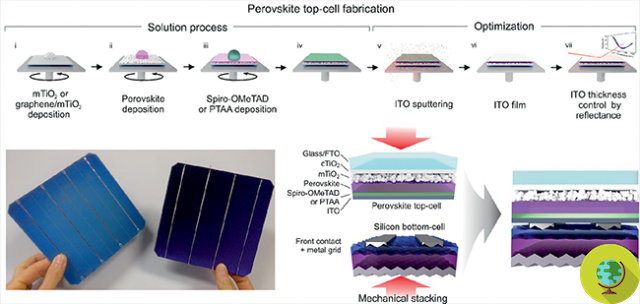

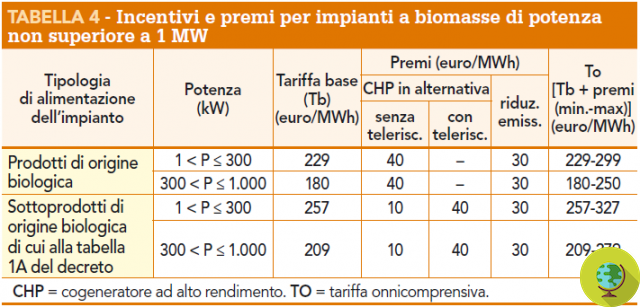

As far as the 'ecobonus, includes the energy requalification interventions of existing buildings, which is responsible for one deduction of 65%. Among them: the installation of solar panels, replacement of winter air conditioning systems, replacement of winter air conditioning systems with high efficiency heat pumps and replacement of traditional water heaters with heat pump water heaters

Francesca Mancuso

READ also:

- Tax deductions 50%: how to access the eco-bonus for furniture and appliances

- Tax deductions: 50% bonus also for kitchens and furniture

- Tax deduction of 55%: there is no coverage for the extension, but it will be definitive

- Deductions 65% and 50% here is how the bonus for the restructuring changes