Solar collectors are also "lined up" against the expensive bills, an excellent technology based on renewable energy sources to produce sanitary water. They have purchase and installation costs but you can take advantage of the 65% IRPEF deduction, as required by the 2022 Budget Law

He is about to end up run over, his mother saves him

Solar collectors also play their part against the expensive bills and even for these it is possible to take advantage of the 65% personal income tax deduction. This was established by the 2022 Budget Law of the Draghi Government.

What are solar collectors

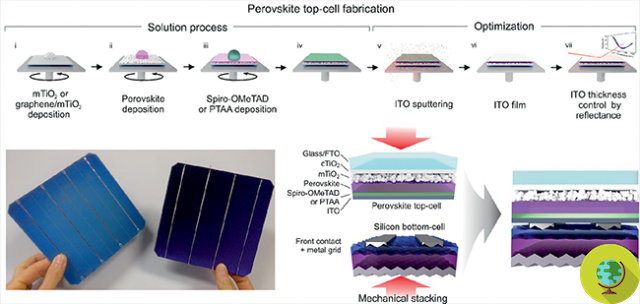

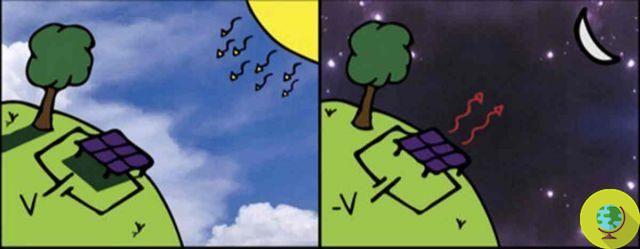

The term "solar collector" indicates a solar thermal panel, which is a device that converts solar energy into thermal, converting the radiation from our star and transferring it to an accumulator, for later use.

They are used to produce sanitary water useful for heating or cooling our home and represent an excellent technology based on renewable energy sources to reduce the consumption of fossil energy sources.

How much do solar collectors cost

Like all technologies based on solar panels, solar collectors also have a significant initial cost. By taking a tour on the net it is easy to verify that by itself buying the panels implies spending around 1500-2000 euro to which the costs for installation must be added.

But you can take advantage of the IRPEF tax deduction at 65% over 10 years, as stated on the website of the Ministry of Economy and Finance. The 2022 Budget Law extended the tax deductions for energy efficiency and building renovation interventions to 31 December 2024, including the purchase and installation of solar thermal panels.

They also come tax deductions for energy efficiency and building renovation interventions have been extended to 31 December 2024, for the ordinary seismabonus and the 50% bonus for the purchase and installation of winter air conditioning systems. The furniture bonus, or the 50% deduction for the purchase of furniture and large appliances of a class of not less than A + intended to furnish a property subject to renovation, is extended until December 31, 2024, with a maximum total cost of € 10.000. for 2022, and € 5.000 for 2023 and 2024

The request must be submitted within 90 days from the end of the works, certainly accompanied by the technician's report proving the requirements, an invoice for all the expenses incurred and of course all the applicant's data.

Added to this is the extension for the whole of 2022 for the facilitation of the recovery and restoration of the façade of existing buildings to which a deduction of 60% is applied and the confirmation of the green bonus until 2024.

Source: Ministry of Economy and Finance

Follow your Telegram | Instagram | Facebook | TikTok | Youtube

Read also:

- Photovoltaic for balconies: you can also ask for a tax deduction for storage systems, here's how

- How to build a solar thermal panel with plastic bottles