Can the personal income tax deductions also be extended to photovoltaics? There are still many doubts

He is about to end up run over, his mother saves him

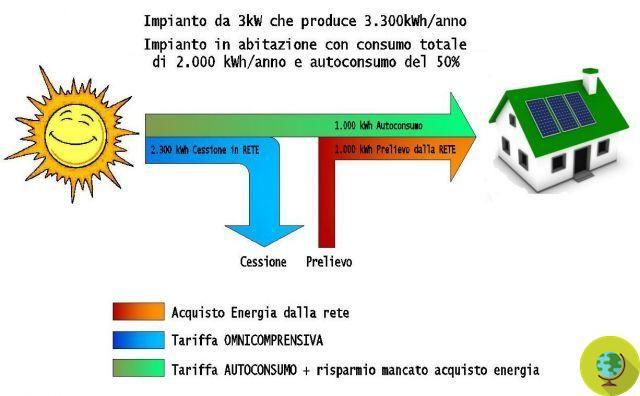

Il PV can fall within the tax deductions Part 50%? It is still not clear. There is a lot of confusion on this point. Everything stems from the regulatory uncertainty on the matter. Initially, in fact, this personal income tax deduction only concerned the solar thermal as it fell within the energy improvement of the buildings, but with the Decree that modified these deductions it created several doubts.

As some companies in the sector have pointed out, in the absence of a univocal interpretation of the law, some territorial Revenue Agencies would have denied the extension of the deduction until June 2013 to photovoltaic systems for the production of electric energy, who only access the mechanisms of the exchange on the spot.

It should be noted that the development decree, published in the Official Gazette in July, ordered pextension of the bonus beyond December 31st, but lowering the deduction threshold from 55 to 50% until 30 June 2013, putting it on a par with the deductions for renovations. So why not put the purchase of on the same level photovoltaic panels to the renovation of electrical, plumbing and heating systems? This is the question that still awaits a clear and definitive answer.

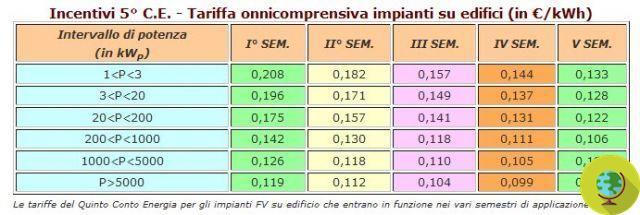

The Gifi-Anie association also asked to include the installation of photovoltaic panels among the deductions already planned for building renovations. "Without prejudice to the not combinable with the incentive rates of I count energy, an interpretation of the law in the sense indicated by us can have an important effect of relaunching consumption ”specifies in a note. And the advantages would not only go to those who intend to buy an energy saving system, but also to create a “new market for those who build it”.

It goes without saying that those who benefit from the incentives provided for by the current one fifth energy tale will not be able to benefit from the personal income tax deduction, but that's another story. A change of perspective is therefore needed. “Equating the installation of a photovoltaic system to a building renovation - he declares Valerio Natalizia President of ANIE / GIFI - is a step forward towards the real integration and standardization of technology in the building system. THE interpretative doubts on the application of the law must be immediately clarified in order not to create further interruptions to the development of the photovoltaic market, in order to support the national photovoltaic industry already heavily affected by the numerous regulatory changes this year. "

Also Confindustria ANIE, for its part, is pressing to ensure that the deduction can also be extended to photovoltaics and in particular to purchases and the construction of photovoltaic systems for the production of electricity on a residential building.

How will it end?

Francesca Mancuso