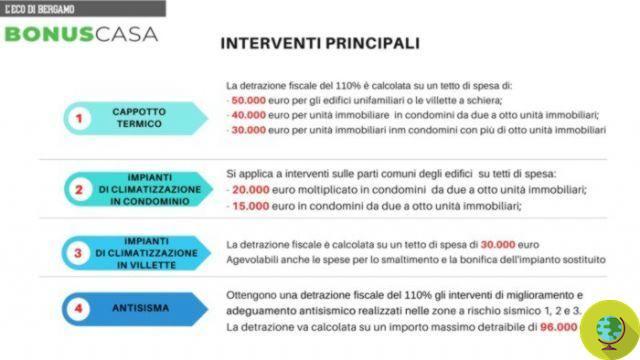

50% Irpef deductions for the installation of photovoltaic systems. This was established by the Revenue Agency, which finally accepted the interpretation of the request for legal advice presented by Anie Confindustria last October.

He is about to end up run over, his mother saves him

50% Irpef deductions can also be applied for the installation of photovoltaic systems. This was established by the Agenzia dell'Entrate, which finally accepted the interpretation of the request for legal advice presented by Anie Confindustria last October.

The subject of the discord was and article 16 bis of Presidential Decree 917 of 1986. According to what was expressed by the request, it was necessary to correctly interpret the aforementioned article and in particular the fact that the deduction already applicable to renovation works for electrical systems, heating and plumbing, it could be also extended to expenses related to the purchase and installation of photovoltaic panels for the production of electricity up to 20 kW nominal. Basically those intended for homes.

How to get the 50% deduction? With the approval of the Revenue Agency, in order to benefit from the deduction, first of all it is necessary that the photovoltaic system is installed to meet the energy needs of the home, therefore for domestic use, power supply of electrical appliances, lighting. Furthermore, those who decide to install the system on the roof of the house will not have to produce the documentation certifying the energy saving since the improvement of the energy performance of the building is directly linked to the system. In this way, the bureaucratic procedures related to the energy certification of buildings are also simplified.

A great news if you think that last December the Inland Revenue had included the installation of panels in the interventions facilitated by 36%, being "works aimed at achieving energy savings, with particular regard to the installation of systems based on use of renewable energy sources ".

To remember. In any case, it is not possible cumulate the 50% personal income tax deduction and the incentive rates linked to the Fifth energy account: it is possible to accumulate the deduction and the exchange on the spot and the dedicated withdrawal.

Francesca Mancuso

Read also:

- Tax deduction of 50%: does photovoltaics also fall into it?