Enea has just made it known that the platform that allows you to send the declarations and documents for the superbonus has been activated

He is about to end up run over, his mother saves himNew pieces in the complicated puzzle for requesting the 110% super bonus. Enea has just made it known that the platform has been activated that allows you to send the declarations and documents necessary to obtain state aid for the energy efficiency of your home.

The compilation of the certification can be done directly on the site, where it is also possible to attach the required documentation. Enea informs that from yesterday 27 October, the day the specific section was activated, 90 days will elapse within which it is necessary to upload the documents relating to the works started and concluded before the date of the online launch of the new portal.

But there will be time until March 16, 2021 to notify the Revenue Agency of any credit transfer relating to the works. In this way, the companies that have acquired it will be able to load it into their tax drawer and take advantage of the deductions.

Enea also informs that the certification must always be done at the end of the work but it is possible to do it during construction for 30% and 60% of the work carried out. It must be drawn up by a qualified technician with an insurance policy expressly stipulated for the SuperEcobonus 110%.

What documents are needed? To complete a certification, the PDF files of the following documents must be uploaded to the system: Copy of the insurance policy, APE before intervention, APE after intervention and metric calculation of the works.

General information on the 110% superbonus

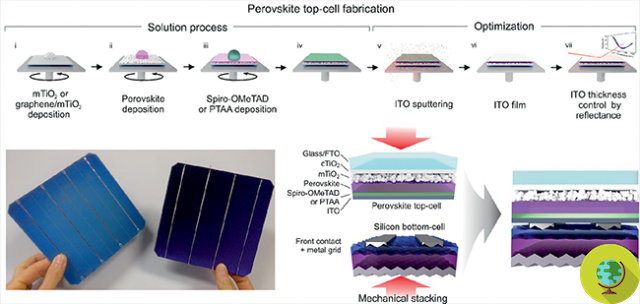

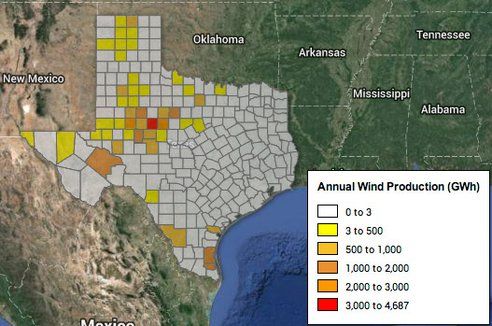

We remind you that the Superbonus is a subsidy provided for by the Relaunch Decree which has brought the deduction rate of expenses incurred from 110 July 1 to 2020 December 31 to 2021%, for some interventions aimed at increasing the energy efficiency of buildings but aimed at also to anti-seismic interventions, to the installation of photovoltaic systems or to the infrastructures for recharging electric vehicles.

Instead of the direct use of the deduction in installments of the same amount obtained in 5 years, it is possible to opt for an advance contribution in the form of a discount from the suppliers of the goods or services or, alternatively, for the transfer of the corresponding credit. to the deduction due.

In this case, a communication must be sent from 15 October 2020 to exercise the option with the appropriate form to be filled in and sent online. Here the model

For all other information, read our in-depth analysis on Super bonus al 110%:

Superbonus 110%: requirements, deductible interventions, deadlines and forms to be submitted

Sources of reference: Revenue Agency, Enea

READ also:

- Superbonus 110%: it will not end in 2021 but will be forever. Word of the Minister of Economic Development

- Superbonus 110%: ecobonus and earthquake bonus approved also for second homes