The 110% Superbonus has been extended until 2023: here are all the news and FAQs published on the Agenzia delle Entrate website

He is about to end up run over, his mother saves himNow it's official: the Superbonus 110% has been extended until 2023 from the budget bill approved by the Council of Ministers. In reality, the maneuver not only extends the time duration of the concession, but changes some criteria, establishing new limits. For condominiums comes the extension of the maxi-deduction to 110% until the end of 2023, then the percentage of expenditure that can be deducted begins to drop to 70% in 2024 and 65% in 2025.

The same deadlines will also apply to interventions on buildings consisting of two to four real estate units separately stacked, owned by the same owner or co-owned by several natural persons.

What is the Superbonus 110%

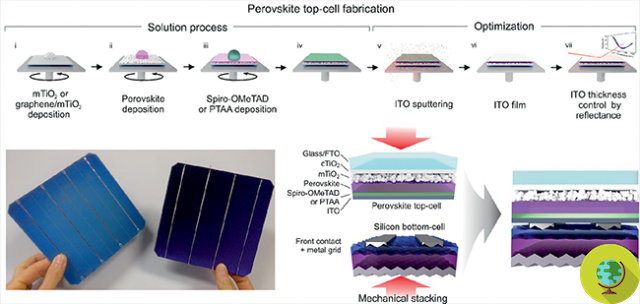

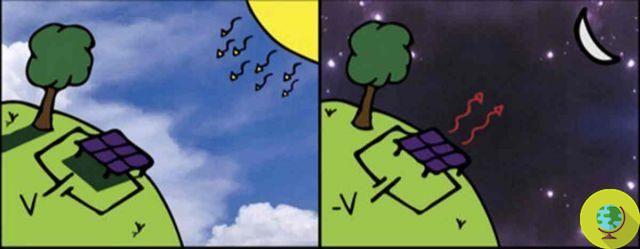

The Superbonus is a subsidy, introduced by the Relaunch Decree, which raises the deduction rate of expenses incurred for specific interventions in the field of energy efficiency, anti-seismic interventions, installation of photovoltaic systems or infrastructures for recharging to 110%. electric vehicles in buildings.

The Superbonus applies to interventions carried out by:

- condominiums

- natural persons, outside the exercise of business activities, arts and professions, who own or hold the property object of the intervention

- natural persons, outside the exercise of business activities, arts and professions, owners (or co-owners with other natural persons) of buildings consisting of 2 to 4 distinctly stacked real estate units

- autonomous public housing institutes (Iacp), however named, or other entities that meet the requirements of European legislation on "in house providing" on properties owned by them or managed on behalf of municipalities, used for public housing.

residential cooperatives with undivided ownership on properties owned by them and assigned to their own non-profit members, voluntary associations and social promotion associations, amateur sports associations and societies, limited to works intended only for buildings or parts of buildings used as changing rooms

This facilitation is due in the event of:

- thermal insulation interventions on the casings

- replacement of the winter air conditioning systems on the common parts

- replacement of winter air conditioning systems on single-family buildings or on housing units of multi-family buildings

- functionally independent

- anti-seismic interventions: the deduction already provided for by the Sismabonus is raised to 110% for expenses incurred from 1 July 2020 to 31 December 2021.

In addition to these interventions, the Superbonus can also be used for expenses incurred for interventions carried out together with at least one of the main thermal insulation interventions, replacement of winter air conditioning systems or reduction of seismic risk, namely: energy efficiency interventions ; installation of solar photovoltaic infrastructures for charging electric vehicles

interventions for the elimination of architectural barriers.

The FAQ

To clarify the facilitation, the Revenue Agency has published some FAQs on the site relating to the obligation of a compliance visa and certification to exercise the option for the discount on the invoice or the transfer of credit. Here are all the explanations regarding the bonus.

With reference to works for the recovery of the building heritage referred to in art. 16-bis, paragraph 1, letters a) and b), of the TUIR, a taxpayer, following receipt of the invoice from a supplier, on 11 November 2021 made the payment of the amount provided therein remained at his expense, but as of November 12, 2021 (date of entry into force of the decree-law November 11, 2021, n. 157) has not yet transmitted to the Revenue Agency the communication of the option for the discount on the invoice. The regime prevailing upon the entry into force of decree law no. 157 of 2021, which does not require, for the purposes of the aforementioned option, neither the compliance visa nor the sworn statement, or the new regime provided for by the aforementioned law decree which, on the other hand, requires the aforementioned obligations to be borne by the taxpayer?

Article 121, paragraph 1-ter, of the decree-law of 19 May 2020, n. 34 (introduced by the decree-law 11 November 2021, n.157) - which provides, also for bonuses other than the Superbonus, the obligation of the compliance visa and certification for the purposes of the option for the discount on the invoice or the credit transfer - applies, in principle, to communications transmitted electronically to the Revenue Agency starting from 12 November 2021 (date of entry into force of decree-law no. 157 of 2021).

However, it is considered worthy of protection the trust of taxpayers in good faith who have received invoices from a supplier, fulfilled the relative payments against them and exercised the option for the transfer, through the stipulation of agreements between the transferor and transferee, or for the discount on the invoice, by means of the relative annotation, before the date of entry into force of the law decree n. 157 of 2021, even if they have not yet sent the electronic communication to the Revenue Agency; it is therefore believed that in such cases the aforementioned obligation to affix the approval of compliance with the communication of the option to the Revenue Agency and certification does not exist. In this regard, it should be noted that, in order to allow the transmission of such communications, the related telematic procedures of the Revenue Agency will be updated by next November 26th.

It goes without saying that the communications of the options sent by 11 November 2021, relating to deductions other than the Superbonus, for which the Revenue Agency has issued a regular acceptance receipt, are not subject to the new regulations referred to in paragraph 1- ter of article 121 of law decree no. 34/2020 and, therefore, the affixing of the approval of conformity and the asseveration of the adequacy of the expenses are not required. The related credits can be accepted, and possibly further transferred, without requiring the approval of conformity and the asseveration of the adequacy of the expenses, even after 11 November 2021, without prejudice to the preventive control and suspension procedure referred to in Article 122 -bis of the law decree n. 34/2020, introduced by the law decree n. 157 of 2021.

Pending the adoption of the decree of the Ministry of ecological transition referred to in paragraph 13-bis of article 119 of law decree no. 34 of 2020, relating to the identification of the maximum values for certain categories of goods for the purpose of certifying the adequacy of expenses, is it possible to refer to the price lists identified by the decree of the Ministry of Economic Development of 6 August 2020?

Yes, the ministerial decree of 6 August 2020 ("Technical requirements for access to tax deductions for the energy redevelopment of buildings - so-called Ecobonus"), with the related attachments, is still in force and it is correct to refer to it, in waiting for the adoption of the aforementioned decree of the Ministry of ecological transition. It should also be noted that pursuant to article 119, paragraph 13-bis, of the decree law n.34 of 2020, "Pending the adoption of the aforementioned decrees, the appropriateness of expenses is determined by referring to the prices shown in the price lists prepared by the regions and autonomous provinces, to the official price lists or to the price lists of the local chambers of commerce, industry, crafts and agriculture or, failing that, the current market prices based on the place where the interventions are carried out

The certification provided for the interventions subject to bonuses other than the Superbonus, referred to in paragraph 2 of article 121 of law decree n. 34 of 2020, must certify the technical requirements of the intervention and the actual realization, as foreseen for the Superbonus, or does it only concern the appropriateness of expenses?

Article 121, paragraph 1-ter, letter b), of law decree no. 34 of 2020 expressly provides that the qualified technicians "certify the appropriateness of the expenses incurred" and, therefore, it is believed that the new certification requested must refer to it. Obviously, compliance with the requirements and fulfilments specifically envisaged for the use of tax concessions other than the Superbonus referred to in paragraph 2 of the aforementioned article 121 of the Relaunch decree remains unaffected. For example, for interventions aimed at energy saving that give the right to the deduction referred to in Article 14 of Law Decree no. 63 of 2013, it is necessary to put in place the obligations provided for by the ministerial decree of 6 August 2020 (requirements) in the case of interventions carried out starting from 6 October 2020, or, by the inter-ministerial decree of 19 February 2007 for those started on an earlier date.

A taxpayer in the year 2021 incurred expenses for interventions falling within the so-called Superbonus, for which he intends to benefit from the corresponding deduction in the tax return relating to the tax period 2021. In consideration of the mandatory compliance visa, introduced by the law decree 157 of 2021, even if the Superbonus is used in the form of a deduction, the visa must be requested in relation to the entire declaration in which the deduction is indicated or can refer only to the data relating to the documentation certifying the existence of the conditions that give the right to the deduction in question?

Paragraph 11 of article 119 of law decree no. 34 of 2020, as amended by law decree n. 157 of 2021, introduced the requirement of a compliance visa even in the event that, with reference to the expenses for interventions falling within the so-called Superbonus, the taxpayer benefits from the relative deduction in the tax return, except in the case in which the declaration is presented directly by the taxpayer or through the withholding agent who provides tax assistance. Except in these cases, it is believed that the compliance visa should be requested only for the data relating to the documentation that certifies the existence of the conditions that give the right to the deduction. The taxpayer is required to keep the documentation certifying the issuance of the compliance visa, together with the supporting documents of the expenses and the certificates that give the right to the deduction. It is understood that the taxpayer is required to request a compliance certificate on the entire declaration in the cases provided for by law (for example, see article 1, paragraph 574, of law no.147 of 2013, according to which taxpayers who, pursuant to 'Article 17 of Legislative Decree no.241 of 1997, use as compensation the credits relating to income taxes and related surcharges, withholding taxes, substitute taxes for income taxes and the regional tax on productive activities, for amounts exceeding 5.000 euros per year, they are obliged to request the affixing of the compliance visa, relating to the individual declarations from which the credit emerges). It goes without saying that the approval of the entire declaration, in this case, is absorbent of the above-described obligation referred to in paragraph 11 of article 119.

The technicians qualified to verify the adequacy of the expenses for the interventions admitted to the Superbonus can also certify the adequacy provided for by decree-law n. 157 of 2021?

It is believed that the technicians authorized to issue the sworn certificates provided for by article 119, paragraph 13, of law decree no. 34 of 2020 for the interventions admitted to the Superbonus can issue, for the same type of intervention, also the asseveration of the adequacy of the expenses incurred provided for by article 1 of decree law n. 157 of 2021. For example, for interventions that allow access to the Sismabonus (not included in the Superbonus 110%), the person authorized to issue it for interventions to reduce the seismic risk that damage right to the Superbonus.

For more information on the Superbonus, consult the website of the Revenue Agency

Follow us on Telegram | Instagram | Facebook | TikTok | Youtube

Source: Revenue Agency

Read also:

- Superbonus 110%: extended until 2022. All the news

- Superbonus 110%: the Enea portal is launched for sending sworn certificates and documents

- Superbonus 110%: requirements, deductible interventions, deadlines and forms to be submitted

- Superbonus 110%: ecobonus and earthquake bonus approved also for second homes