Quota 100, the presentation of applications for early retirement starts today. Approved on January 17, the decree law established new rules that will allow certain categories of people to leave their jobs earlier than the retirement age

Don't store avocado like this: it's dangerous

Quota 100, the presentation of applications for early retirement starts today. Approved on January 17, the decree law established new rules that will allow certain categories of people to leave their jobs earlier than the retirement age.

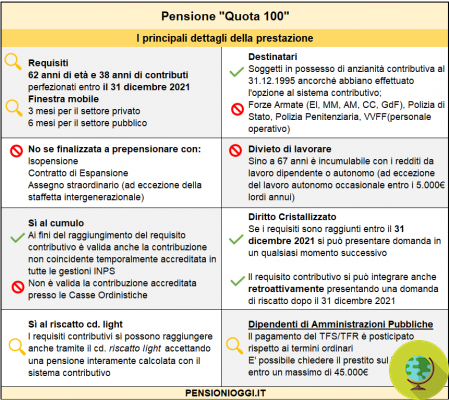

The new system considers the sum of the worker's age and the contributory age (62 years of age and 38 years of contributions). If the value is equal to 100, you may be entitled to an early pension. An experimental measure that will be valid until 2021, also affecting those who meet the requirements by 31 December 2021.

However, a solution that displeases the companies that will help workers to reach retirement with a quota of 100 through bilateral solidarity funds. According to aanalysis conducted by Sole24ore, this possibility makes it possible to use these funds to pay an extraordinary allowance to support the income of workers who will meet the requirements for quota 100 by 31 December 2021.

In particular, companies will have to pay to the fund: an extraordinary contribution to cover the entire amount of the allowance to the worker, the contributions related to the redundancy period and the expenses that INPS will face in managing the checks. In addition, they will have to undertake to hire a certain number of workers to replace those who have retired with the 100 quota.

But let's find out the requirements to access Quota 100 and how to submit the application.

The requirements

The quota 100 concerns workers registered with the compulsory general insurance (AGO), the special management of self-employed workers, the separate management of INPS and the replacement and exclusive funds of the compulsory general insurance.

There is only one combination possible to center the release: 62 years of age and 38 years of contributions. Numbers in hand, this will allow about 290 thousand workers to retire, especially men in the state sector. In any case, the age requirement of 62 years will not be adequate for the life expectancy that will start on January 1, 2021.

How to submit the application

Let the INPS know that from today whoever is in possession of the requisites can present the application for quota 100. First of all, you must be in possession of the access credentials (PIN issued by the Institute, SPID or National Service Card) through which you can fill in and send the online application on the INPS website in the "Pension application, Reconstitution, Accruals, ECOCERT, Social APE and Early Benefits".

After logging in, you must select the "New application" option from the left menu by selecting "Seniority / old age pension"> "Seniority / early pension"> "Quota requirement 100". Finally, the Fund and the Settlement Management must be selected.

Alternatively, it is also possible to submit the application through CAF and Patronati.

Francesca Mancuso