All you need to know about the furniture and appliances bonus, extended until 2024: deductible amount, permitted purchases and how to benefit from the discount

He is about to end up run over, his mother saves himThe bonus is back furnishings ed appliances: the facility to renovate the furnishings of the homes undergoing renovation has been confirmed by the Budget Law also for 2022. For this year the maximum repayment limit is equal to 10 thousand euros, while in the next two years it will drop to 5 thousand. Let's find out what this tax deduction consists of, who can benefit from it and what interventions are allowed.

Read also: TV bonus: the concession has been renewed also for 2022, free decoders for the over 70s

Index

What does the furniture and appliances bonus consist of?

The bonus is nothing more than a 50% personal income tax deduction that is due to those who decide to buy both furniture and large appliances, intended to furnish a property undergoing renovation. This deduction must be calculated on a maximum amount of 10.000 euros for the year 2022 (in 2021 the expenditure ceiling on which to calculate the deduction was equal to 16.000 euros) and of 5.000 euros for the years 2023 and 2024, and also includes any transport and assembly costs.

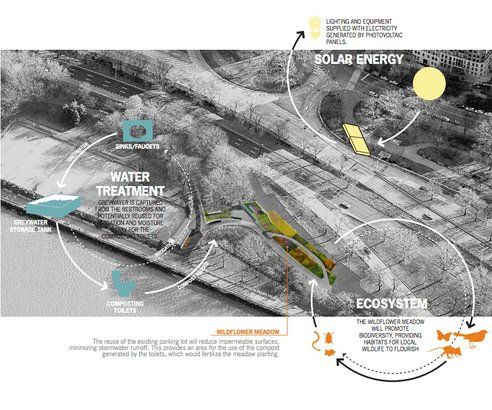

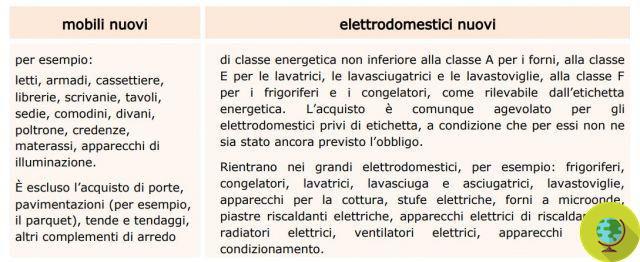

As clarified on the Revenue Agency website, the deduction is intended exclusively for those who intend to purchase the following furniture or appliances:

@ Revenue Agency

Those who purchase new furniture and appliances (not lower than class A for ovens, class E for washing machines, washer-dryers and dishwashers, class F for refrigerators and freezers) can benefit from the deduction by 31 December 2024 and has carried out building renovation works starting from 1 January of the year preceding that of the purchase of the assets.

The building interventions necessary to take advantage of the Bonus

But what are the building interventions necessary to obtain the deduction? The complete list of works is reported in the guide of the Revenue Agency:

- extraordinary maintenance, restoration and conservative rehabilitation, building renovation on individual apartments. Ordinary maintenance work on individual apartments (for example, painting of walls and ceilings, replacement of floors, replacement of external fixtures, refurbishment of internal plaster) do not give the right to the bonus

- reconstruction or restoration of a property damaged by calamitous events, if a state of emergency has been declared

- restoration, conservative rehabilitation and building renovation, concerning entire buildings, carried out by construction companies or real estate renovations and by building cooperatives that sell or assign the property within 18 months of the completion of the works

- ordinary maintenance, extraordinary maintenance, restoration and conservative rehabilitation, building renovation on common parts of residential buildings

How to take advantage of the personal income tax deduction

To obtain the deduction on purchases of furniture and appliances, payments must be made by bank transfer or debit or credit card. However, it is not allowed to pay by bank check, cash or other means of payment. If the payment is made by bank or postal transfer, it is not necessary to use the one (subject to withholding tax) specially prepared by banks and post offices for building renovation costs. The deduction is allowed even if the assets were purchased with an installment loan, provided that the company providing the loan pays the amount in the same manner indicated above and the taxpayer has a copy of the payment receipt.

These are the documents to keep:

- Bank transfer receipt

- transaction receipt (for payments

by credit or debit card) - debit documentation on the current account

- invoices for the purchase of goods, showing the nature, the

- quality and quantity of goods and services acquired

For more info on the furniture and appliances bonus you can consult the section of the Revenue Agency website.

Follow your Telegram | Instagram | Facebook | TikTok | Youtube

Read also:

- Eco-bonus 65% to heat water with solar collectors on the roof: how it works

- Car incentives 2022, the decree arrives. Who can apply for the eco-bonus and how to submit the application